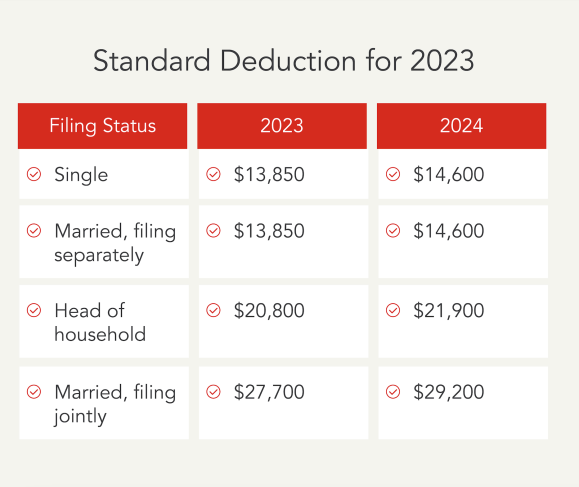

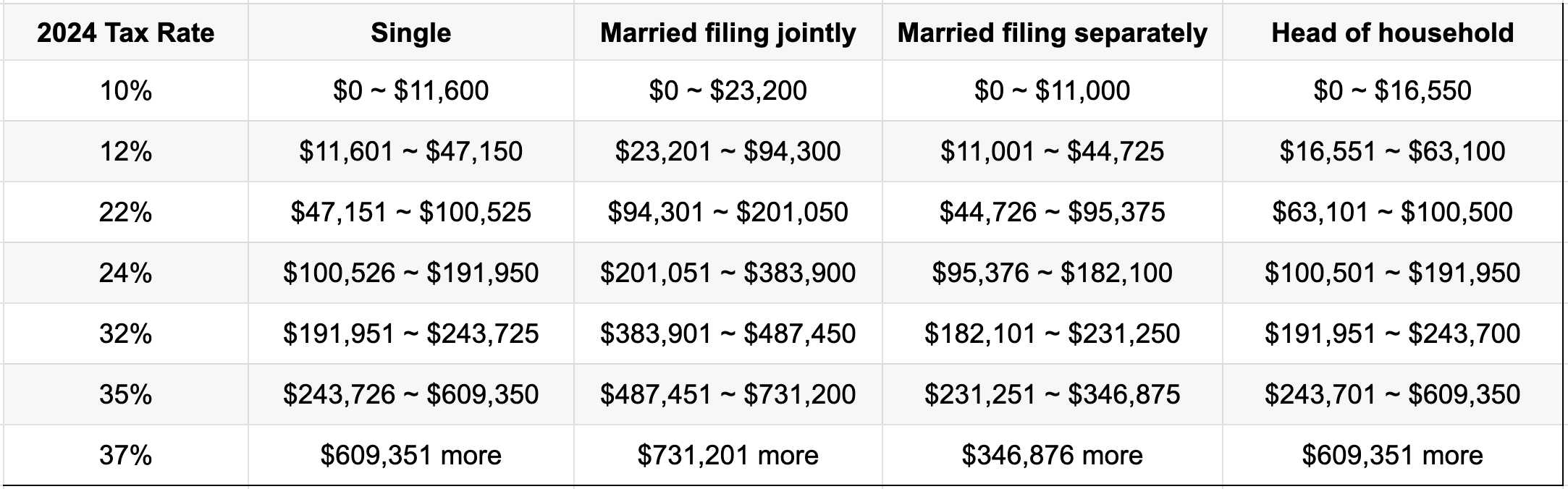

Itemized Deductions In 2024 – The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2024, which could result in a lower tax bill for many Americans. . For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. .

Itemized Deductions In 2024

Source : www.schwabcharitable.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comKick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.comStandard vs. Itemized Deduction Calculator: Which Should You Take

Source : blog.turbotax.intuit.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comHow to Boost Itemized Deductions in 2024

Source : www.cgteam.comTax for Business | Blog Post Categories | PriorTax.com

Source : www.blog.priortax.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comYear end tax strategy ideas as 2024 approaches Sol Schwartz

Source : www.ssacpa.comTop 10 Tax Deductions to Claim for 2024 Chime

Source : www.chime.comItemized Deductions In 2024 Bunching charitable contributions | Schwab Charitable Donor : Want to get the biggest tax refund for tax year 2023? Check out these easy tips for filing an accurate, on-time tax return to increase your refund. . Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial .

]]>